Foresee the Game Industry in 2020: Booming Puzzle Games and Role-playing Games

At the turn of the year, some are in delight, while others in distress; so is the game industry this year. Looking back at 2019, the industry witnessed the removal of account bans, the dampened passion about going global, and the release of popular games and creative designs. Both the market pattern and the gamers’ preferences are ever-changing. Looking ahead into 2020, there are signs that puzzle and role-playing games may continue to yield extraordinary results, accompanied by the outstanding performance of creative videos and promising prospects for playable ads.

Based on the world-leading advertising information analysis tools independently developed by the company, SocialPeta released the 2019 data report on mobile advertisements in the game market, revealing the analysis of advertiser types, network data analysis, comparison of data in different mobile operating systems and popular creative analysis. The report serves as a reference for the game industry and mobile industry. Below is the report overview.

Summary

Ads for puzzle games accounted for the largest portion while those for the role-playing games witness the fastest growth.

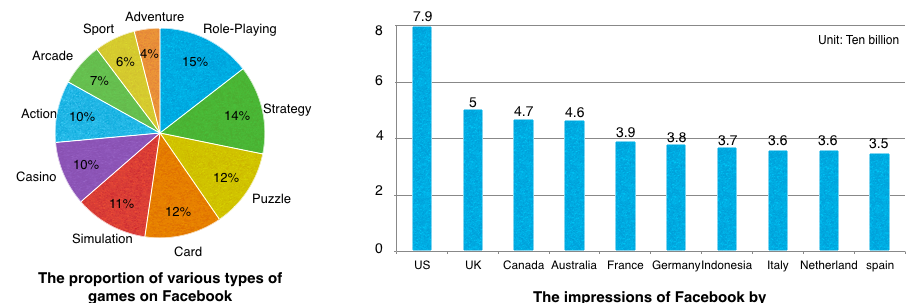

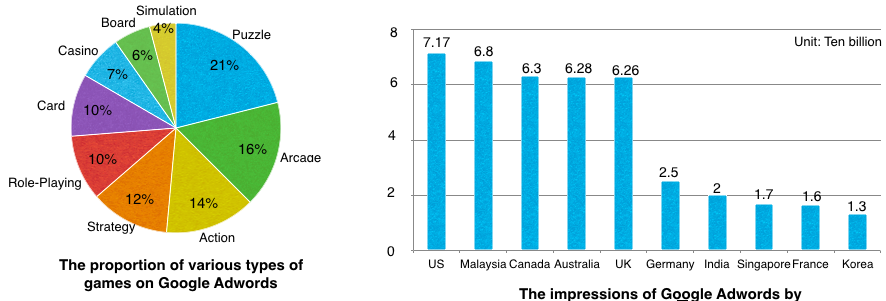

Facebook and Google Adwords are the most important networks. Casual games take up half of the chart on AppLovin.

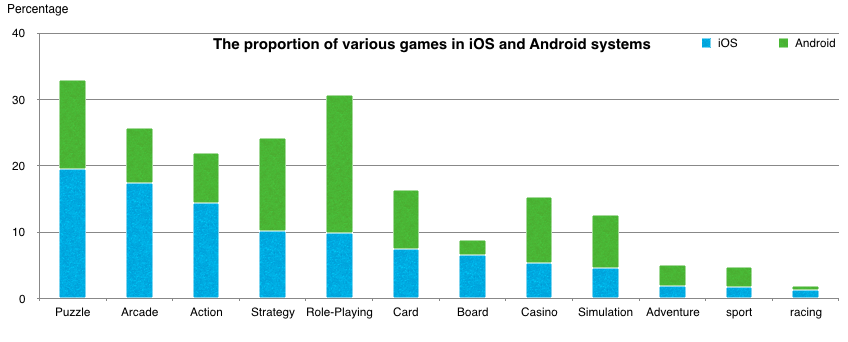

Casual games occupy a larger share in iOS while mid-heavey games play a dominant role in the Android system.

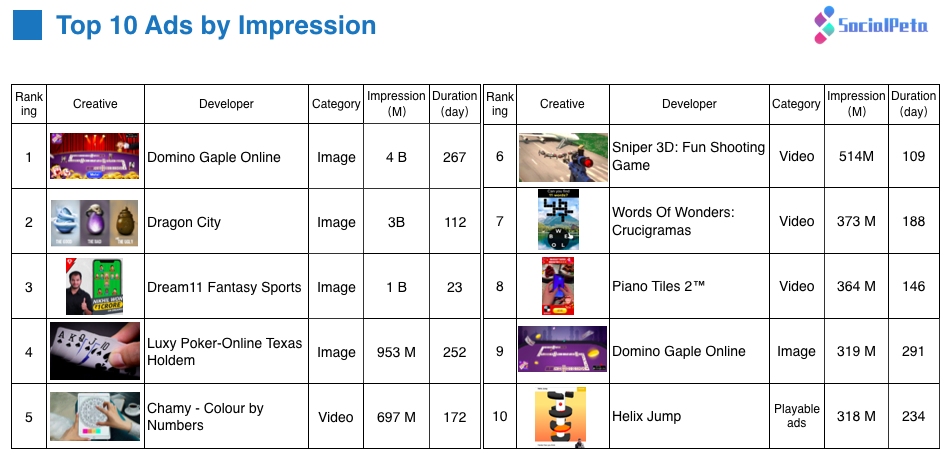

Video creatives yield satisfactory results and image creatives are the most frequently displayed.

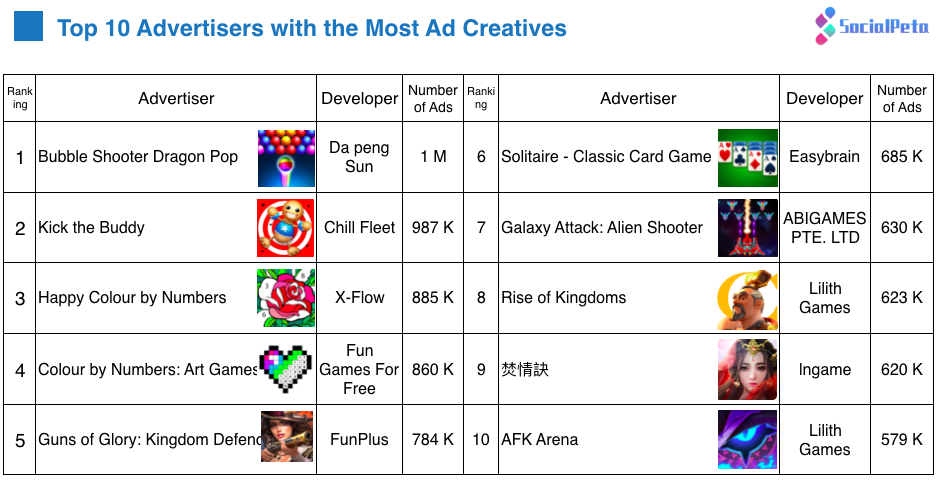

Advertisers: puzzle and role-playing game are major advertisers

With 20% of total impressions, 18% of ad creatives quantity and 33% of advertising time, puzzle game developers top the list of advertising in 2019, followed by arcade games.

Role-playing games maintain strong growth momentum from April to October and they have witnessed several peaks of growth in summer. Role-playing games rank top in terms of the number of advertisers, followed by arcade and strategy games.

Advertising networks: distinctive regional differences and balanced type distribution

Game publishers from countries including the U.S., Britain, Canada, and Australia released more in advertisements on Facebook and Google Adwords, followed by those from Germany and India. Except for the U.S., most countries released ads via varied networks with uneven proportions.

Casual game publishers prefer to advertise via Google Adwords. In particular, puzzle games account for the largest share in this network. The performances of role-playing games, strategy games, puzzle games, card games, and casino games are having a close race on Facebook.

Operating systems: iOS and Android enjoy equal popularity

Casual games such as puzzle and arcade games enjoy a larger share on iOS, with Html being the leading creative ad creatives. While mid-heavy games such as role-playing and strategy games are more popular on the Android system, and videos are the dominant ad creatives.

It is noteworthy that videos are significantly important for both iOS and Android. The proportion of playable ads has increased compared with that of 2018 and is expected to continue to grow in 2020.

Ad creatives:

Casual games and competitive games make the largest contribution to the ad creatives throughout the year, with slight differences among advertisers. With regard to quantity, video and image creatives have equal shares. It should be noted that the top 10 playable creatives also have outstanding impressions. Thus, this type of creative makes significant contributions to the media buy of casual games. According to the popular copywriting of Kick the Buddy, expressions that can reflect the features and promotional activities of the game, are used frequently.

Download the report to see more: